Exter’s Liquidity Pyramid, Reframed for 2025: Silver at the Apex, Gold and Crypto in the Point Cluster

- Mark Lafond, RA

- Sep 16, 2025

- 6 min read

Updated: Dec 5, 2025

Discovering the Silver Renaissance: Unlocking the Potential of an Overlooked Asset

Thesis and Scope

This article rewrites John Exter’s inverted liquidity pyramid to reflect the redefining specification of “true money” at the Apex. Silver sits at the tip due to diminishing above-ground stock and persistent deficits, gold shares the point cluster as neutral reserves money, and crypto and digital assets sit adjacent as bearer money and tokenization rails.

Cash and deposits are not the base, they are issuer claims that belong above the point. The map below preserves Exter’s core idea, in stress, capital falls toward the narrowest, scarcest, final-settlement assets. [1][2]

Who John Exter Was and Why His Pyramid Endures

John Exter, 1910 to 2006, was an American central banker and the founding governor of the Central Bank of Ceylon, today Sri Lanka. His 1949 blueprint, often called the Exter Report, set the legal and operational foundations for an independent monetary authority.

He later served in senior roles at the Federal Reserve, including the New York Fed, and wrote widely on debt cycles, inflation, and financial structure. Exter’s pyramid was a teaching device, a picture that organized the financial system by settlement quality rather than by size or yield. At the broad top sit leveraged claims that thrive in calm periods. At the narrow bottom sit the few assets that close obligations without anyone else’s promise.

The power of the model is its simplicity, when confidence erodes, the path of capital is down the layers toward final settlement. [1][2][3][4]

True Money Is Not Cash

In Exter’s logic, what matters in a crunch is who must still perform for you to be paid. Cash and deposits are liquid in normal times, yet they are liabilities of issuers, banks or the state. They depend on convertibility promises, payment systems, and policy backstops. True money is neutral, a bearer asset that settles by delivery, with no further performance required from an issuer. In Exter’s era that meant monetary gold. In a modern setting it also includes silver, a historic settlement metal with tightening supply, and reserve-grade crypto that functions as digital bearer money. These instruments, not cash, belong at the point. [1][2]

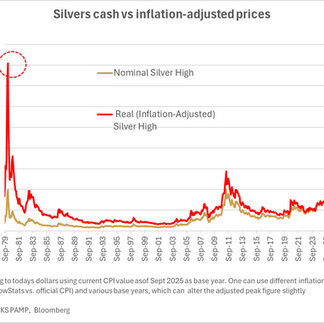

Why Silver Occupies the Tip

Silver is both industrial and monetary, a dual character that becomes decisive in stress. Industry research has documented repeated annual deficits in the physical market, driven by photovoltaics, power electronics, and electrification, only partly offset by thrifting.

Mined grades have declined over time at many primary producers, new world-class discoveries are scarce, and recycling is sensitive to price and scrap flows. Wholesale vault data and warehouse trends show that visible inventories can be drawn down for long periods when fabrication demand is firm. The net effect is a progressively tighter above-ground float. In a liquidity cascade, this scarcity, coupled with silver’s long history as settlement money, earns it the literal tip of the pyramid. [5][6][7][8]

Gold in the Point Cluster

Gold remains the archetype of neutral reserves. It is a non-liability asset, held outright by private actors and by central banks that have been steady net buyers in recent years. That official-sector demand is not about price speculation, it is about balance sheet resilience and sanction neutrality. In Exter’s map, gold’s role is to anchor the base of settlement quality. In this update gold stands beside silver in the point cluster, just above the tip, reflecting unmatched global salability and deep liquidity. [9]

Crypto and Digital Assets Beside the Point

Crypto sits near the point for two reasons. First, reserve-grade crypto functions as a digital monetary commodity, with no credit counterparty. Its price volatility is higher than that of metals, yet its settlement finality and bearer design are consistent with Exter’s focus on performance-free assets. Second, programmable ledgers now carry tokenized claims on traditional money and bills, and fully reserved stablecoins that operate as near-cash.

Tokenization projects described by central-bank research envision platforms where reserves, deposits, and government bonds interoperate, reducing friction in the movement of money-like claims. In this taxonomy, “Crypto & Digital Assets” sits near silver and gold as bearer money and as the technology of asset tokenization, while tokenized T-bill funds and fully reserved stablecoins reside one layer higher as rails. [10][11][12]

Cash, Rails, and Bills Above the Point

Cash and insured deposits are essential for daily operations, but they remain someone’s liability. Even when fully accessible, they are a step removed from final settlement. Near-cash rails, including fully reserved stablecoins and tokenized T-bill funds, provide speed and transparency but add wrapper, platform, and legal layers that keep them above the point. Treasury bills in top jurisdictions serve as core market collateral, yet they still rely on issuer performance and market functioning, so they also sit above the point cluster. None of this diminishes their usefulness, it clarifies their place in an Exter-style liquidity map. [1][10][11][12]

The Updated Inverted Pyramid, From Top to Apex

Read this as a behavior map, not a price forecast. The order reflects where capital tends to run in a loss of confidence, starting at the broad, leveraged layers and moving down to the point.

Derivatives and synthetic claims, the most leverage sensitive layer.

Private markets and alternatives, private equity, private credit, venture, infrastructure, with long lockups and gating risk.

Public equities and listed real estate, liquid in good times, first to reprice when funding costs rise.

Investment grade credit and agency mortgages, duration and credit spread risk widen in stress.

High quality sovereign bonds, notes and bonds of top jurisdictions, duration remains a source of drawdown.

Near-cash and settlement rails, fully reserved stablecoins, tokenized T-bill funds, and narrow money market funds, efficient rails, not final settlement.

Cash and overnight balances, physical currency and insured deposits, liquid, yet issuer liabilities.

Apex, the point cluster of true money, Silver at the tip, then Gold, then Crypto & Digital Assets adjacent as bearer money and programmable settlement. [1][5][6][7][8][9][10][11][12]

Why This Ordering Matters in Practice

A liquidity squeeze is a contest for settlement quality. Portfolios that cannot descend the pyramid quickly, for example those trapped in long-duration credit or private vehicles, face forced selling and haircuts. Portfolios with prepositioned apex assets can source collateral and optionality when spreads widen. On modern rails, fully reserved stablecoins and tokenized T-bill funds can accelerate movement between layers, but they do not replace the function of the point. The point is where obligations end. [10][11][12]

Silver, Gold, and Crypto as a System Hedge

A practical approach is to separate operating liquidity from system hedges. Operating liquidity lives in cash and near-cash rails. System hedges live at the point cluster. Within that cluster, silver is the leading edge for those who accept higher cyclicality in exchange for structural scarcity and inventory risk, gold supplies depth and neutrality, while crypto and digital assets supply bearer settlement and rail utility with higher market beta. Sizing depends on mandate, yet the logic is consistent, use the point to insure against a tightening cycle in which convertibility slows and margin demands rise. [5][6][7][8][9][10]

Common Objections and Responses

Some object that crypto’s volatility disqualifies it from any lower placement. The map answers by placing crypto near, not at, the tip, beside gold, with a clear acknowledgment of higher beta. Others argue that silver’s industrial cyclicality makes it a mid-tier commodity. That view underweights the structural deficit evidence and stock drawdowns that change the character of available float over time. Finally, a cash-first view sees deposits as the safest layer. Cash is indispensable, but Exter’s question is different, what closes the loop when trust is scarce. On that criterion, true money sits at the point. [1][2][5][6][7][8][10][11][12]

Policy and Market Signals to Watch

For silver, watch fabrication demand in photovoltaics, thrifting rates, mine grade trends, and the trajectory of visible inventories. For gold, track central bank purchases, especially in reserve-diversifying regions. For crypto and rails, watch regulatory alignment, reserve disclosures for stablecoins, growth of tokenized government funds, and the legal enforceability of on-chain title. Each signal informs how easily portfolios can descend the pyramid when stress arrives. [5][6][7][8][9][10][11][12]

Conclusion

Exter’s picture survives because it tells the truth about stress. Capital flees promises and seeks final settlement. In 2025, the point cluster is a set of bearer assets led by silver at the tip, then gold, then crypto and digital assets that carry both monetary and rail functions. Cash and near-cash remain essential tools, yet they sit above the point because they are still claims. Organize portfolios by this map, and you gain the ability to move down the pyramid when others cannot. [1][2][5][6][7][8][9][10][11][12]

Works Cited

Exter, John. “Debt, Inflation and the Future.” Economic Review, Federal Reserve Bank of Richmond, 1973.

Exter, John. Report on the Establishment of a Central Bank for Ceylon. Government of Ceylon, 1949.

Central Bank of Sri Lanka. “John Exter, First Governor, 1950–1953.” Central Bank of Sri Lanka, institutional biography.

Wijewardena, W. A. “John Exter, Central Banker for All Times.” Bank for International Settlements, 2007.

The Silver Institute. World Silver Survey 2025. Metals Focus for The Silver Institute, 2025.

The Silver Institute. “Global Silver Market to Remain in Deficit.” Press release, 2025.

U.S. Geological Survey. Mineral Commodity Summaries, Silver. U.S. Department of the Interior, annual editions.

London Bullion Market Association. “London Vault Holdings, Silver and Gold.” LBMA, periodic data releases.

World Gold Council. Central Bank Gold Reserves Survey 2025. World Gold Council, 2025.

Bank for International Settlements. “The Next-Generation Monetary and Financial System, Tokenisation.” BIS Annual Economic Report 2025, 2025.

Committee on Payments and Market Infrastructures. Tokenisation in the Context of Money and Other Assets. Bank for International Settlements, 2024.

International Organization of Securities Commissions. Policy Recommendations for Crypto and Digital Asset Markets. IOSCO, 2023.

_______________________________________________________________________________